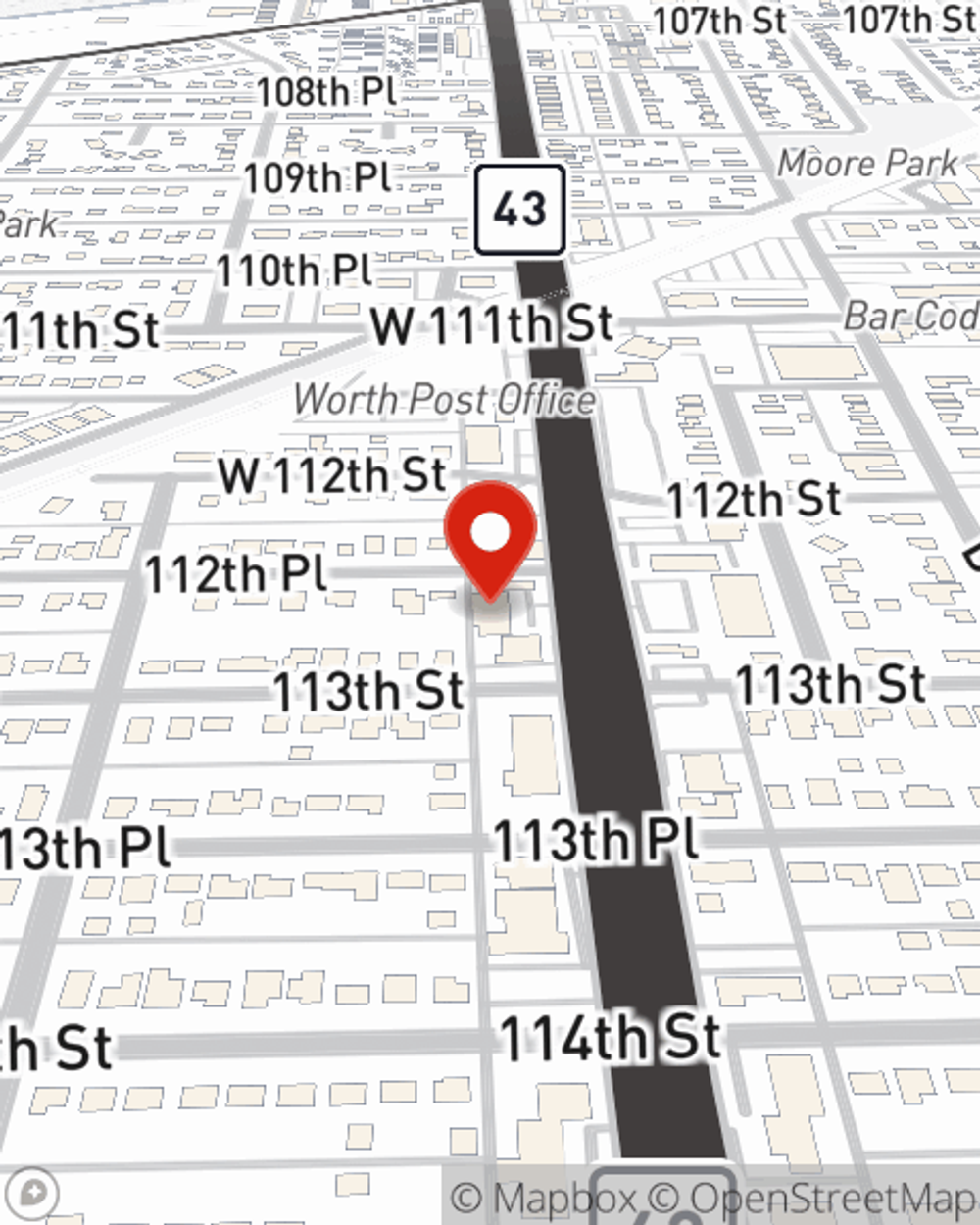

Business Insurance in and around Worth

Searching for protection for your business? Search no further than State Farm agent Ali Khalifa!

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

When you're a business owner, there's so much to consider. We understand. State Farm agent Ali Khalifa is a business owner, too. Let Ali Khalifa help you make sure that your business is properly covered. You won't regret it!

Searching for protection for your business? Search no further than State Farm agent Ali Khalifa!

Almost 100 years of helping small businesses

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your take-home pay, but also helps with regular payroll expenditures. You can also include liability, which is crucial coverage protecting your financial assets in the event of a claim or judgment against you by a customer.

At State Farm agent Ali Khalifa's office, it's our business to help insure yours. Call or email our exceptional team to get started today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Ali Khalifa

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.